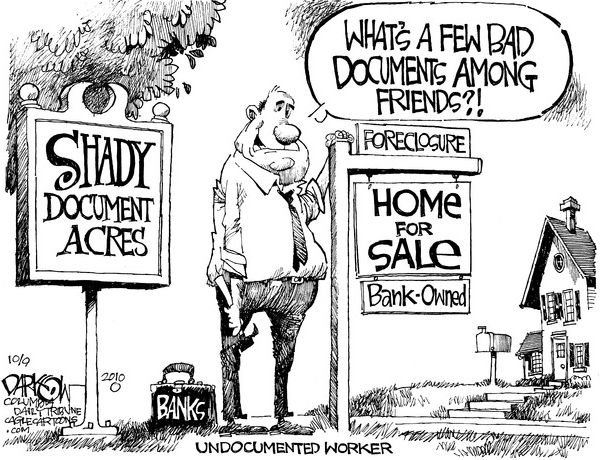

As Americans continue to lose their homes in record numbers, the Federal Reserve is considering making it much harder for homeowners to stop foreclosures and escape predatory home loans with onerous terms.

As Americans continue to lose their homes in record numbers, the Federal Reserve is considering making it much harder for homeowners to stop foreclosures and escape predatory home loans with onerous terms.

The Fed's proposal to amend a 42-year-old provision of the federal Truth in Lending Act has angered labor, civil rights and consumer advocacy groups along with a slew of foreclosure defense attorneys. They're not only asking the Fed to withdraw the proposal, they also want any future changes to the law to be handled by the new Consumer Financial Protection Bureau, which begins its work next year.

Economic Glance

Economic Glance So many Americans have been jobless for so long that the government is changing how it records long-term unemployment. Citing what it calls "an unprecedented rise" in long-term unemployment, the federal Bureau of Labor Statistics (BLS), beginning Saturday, will raise from two years to five years the upper limit on how long someone can be listed as having been jobless.

So many Americans have been jobless for so long that the government is changing how it records long-term unemployment. Citing what it calls "an unprecedented rise" in long-term unemployment, the federal Bureau of Labor Statistics (BLS), beginning Saturday, will raise from two years to five years the upper limit on how long someone can be listed as having been jobless. American International Group Inc., the insurer bailed out by the U.S., garnered $4.3 billion in bank credit lines in another step toward repaying taxpayers and gaining independence. The credit, provided by more than 30 banks and administered by JPMorgan Chase & Co., includes two $1.5 billion facilities, one for three years and the other for 364 days, AIG said today in a regulatory filing.

American International Group Inc., the insurer bailed out by the U.S., garnered $4.3 billion in bank credit lines in another step toward repaying taxpayers and gaining independence. The credit, provided by more than 30 banks and administered by JPMorgan Chase & Co., includes two $1.5 billion facilities, one for three years and the other for 364 days, AIG said today in a regulatory filing. Billions of dollars in top-rated bonds backed by community banks have gone bust, debunking the defense offered by credit-rating agencies that wildly inaccurate ratings were limited to risky mortgage bonds that imploded and then triggered the U.S. financial crisis.

Billions of dollars in top-rated bonds backed by community banks have gone bust, debunking the defense offered by credit-rating agencies that wildly inaccurate ratings were limited to risky mortgage bonds that imploded and then triggered the U.S. financial crisis. The Federal Reserve Board, chastised for regulatory inaction that contributed to the subprime mortgage meltdown, also missed a chance to prevent much of the financial chaos ravaging hundreds of small- and mid-sized banks.

The Federal Reserve Board, chastised for regulatory inaction that contributed to the subprime mortgage meltdown, also missed a chance to prevent much of the financial chaos ravaging hundreds of small- and mid-sized banks. The banks involved include Bank of America, Ally (formerly GMAC), JP Morgan Chase, One WestBank (formerly Indybank), Citibank, and Wells Fargo.

The banks involved include Bank of America, Ally (formerly GMAC), JP Morgan Chase, One WestBank (formerly Indybank), Citibank, and Wells Fargo.